Family discussions of values, rules, goals and mission statements may be just as important to building wealth as any investment strategy or financial plan, according to an advisor’s new book.

Advantage Media Group

“

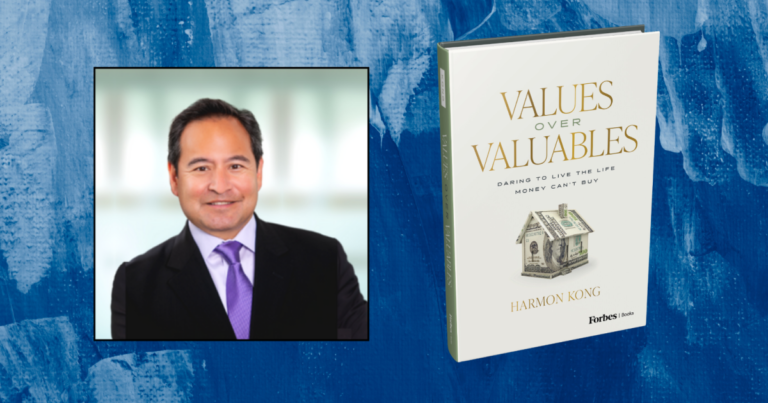

In writing “Values Over Valuables,” Kong “didn’t want to sound like another one of those books, like a textbook,” the 26-year veteran advisor said in an interview.

“When you’re in the business as long as I have been, you’ve heard it all. Sometimes we feel like therapists more than financial advisors,” Kong said. “There has to be an element of a little bit of empathy and understanding and communication. I wanted to focus on that because I thought enough had been written on the financial piece of it.”

Kong’s book added to a wealth of planner-written texts, such as one advisor’s

READ MORE:

Writing books gives advisors a means to present themselves as subject-matter experts and a platform to share their solutions to the pain points among fellow professionals, consumers in general and prospective customers in particular, according to Rory Henry, a director of Marina Del Rey, California-based

“It’s therapeutic, and you’re helping other folks out there solve problems,” Henry said. “It’s the authority in a subject that gives you greater respect within the profession.”

Advisors occupy “an intimate seat at the table” with their clients, since they’re knowledgeable about two topics that are often taboo — money and health, according to Kong.

While he doesn’t view the identification of values or asking the client to describe how their life will look and feel once they achieve their financial goals as “a forced thing or something we ought to do as a fiduciary responsibility,” he said that encouraging client households to hold regular meetings about those topics enables them to “make sure they’re moving in the right direction” as in the case of any business or nonprofit organization.

“What’s the best investment today?” Kong writes. “I’m often asked that question, and I could talk for hours about securities and asset classes and sectors and such. I know in my heart, though, that the best investment has been the same for all time, and it’s either pay now or pay later. You get the greatest dividends and the healthiest return by investing in the people in your life. When you give your relationships priority over your portfolio, you have a reliable growth strategy. When you put family first, you have something money can’t buy. You have ohana.”

To that end, the book can act as a rubric for families at any stage. Exercises in the appendix guide readers in identifying 10 values that resonate and why; selecting five to seven as “core values”; creating vision and mission statements; writing down their goals in general and in nonfinancial realms; and recording “house rules.” Kong shared his family’s rules and its main values of community, faith, family, generosity and service in the appendix as well.

Advantage Media Group

“Ultimately, my hope is that you’ll begin laying the groundwork to have these discussions within your own families,” he writes. “The work you do now will not only benefit your current family but also the generations to come. Money has immense power. It has the power to tear apart families if these topics are not openly discussed. But it also has the power to do good. If you want to ensure the best for your family for generations to come, I urge you to get started now. Schedule your first family meeting. Use the material in the appendix to discover the values that mean the most to your family and create a family mission statement. Above all, I encourage you to simply communicate openly as a family about money issues. I promise you won’t regret it.”

READ MORE:

Kong’s family has been meeting since 2008, and he acknowledged that the first mission statement when his children were young was “probably beyond their scope of understanding.” Similarly, his wife had the idea of ending the meeting with positive affirmations in the form of compliments for each other that were “super funny” and cute when their three kids were young, he said. Today, those kind words can often bring on tears when the family gathers for what now has become an annual retreat, like their ski trip to Japan earlier this year.

People often ask, “Is it too late to have family meetings, or how early do I start them?” Kong said.

“The content isn’t so much as important as the gathering together as a family,” he said, noting that he and his wife carved out dinnertime as a “sacred” family meal. “Is there space in your life where you’re already meeting as a family? It may be the beginning of a family meeting.”