President-elect Donald Trump has proposed raising taxes on the endowments of universities, which could bludgeon Yale’s student aid, teaching and research abilities.

Karla Cortes & Josie Reich

Staff Reporters

Ellie Park, Multimedia Managing Editor

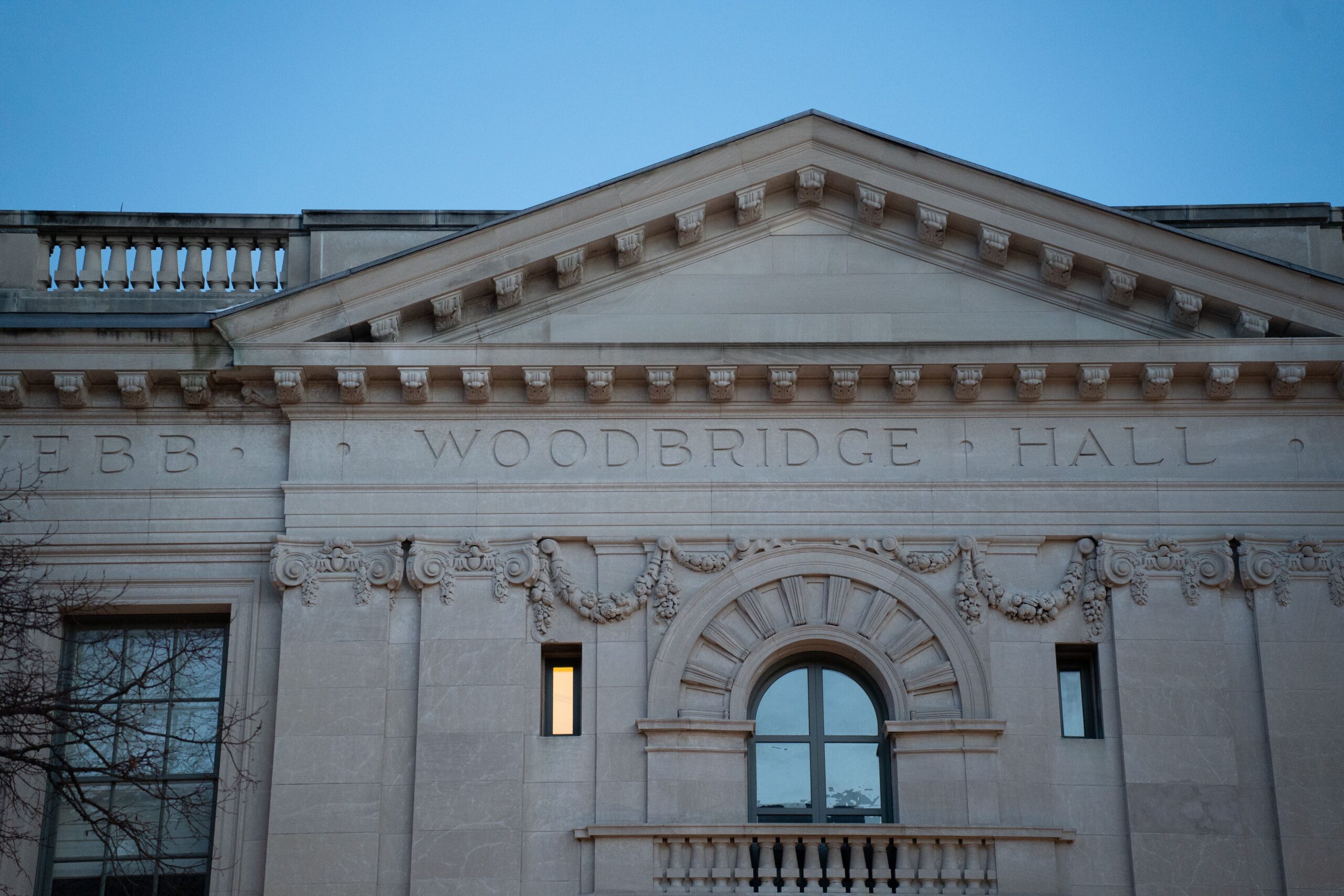

President-elect Donald Trump has said that he will hike taxes on the endowments of large universities that he views as left-leaning. As a result, Yale’s endowment of $41.4 billion could be at risk.

Before Trump’s first presidential term, university endowments were untaxed as a result of their nonprofit status. But in 2017, Trump signed a bill that imposed a 1.4 percent tax on the endowments of most private colleges. In 2023, Vice President-elect JD Vance LAW ’13 introduced a bill to the Senate that proposed dramatically increasing that tax to 35 percent, although the effort was ultimately blocked by Senate Democrats.

This election cycle, Trump and Vance have characterized universities as elite, liberal echo chambers. Their new proposal to tax university endowments, which Trump has suggested could fund a free nonpolitical online university called the American Academy, may serve as an enforcement mechanism to pressure universities into adopting specific practices towards on-campus dissent.

According to Yale College Dean Pericles Lewis and University President Maurie McInnis, Yale has sent representatives to Congress to advocate for its importance to the country. McInnis also traveled to Washington, DC, in October for a series of meetings.

“Ivy League institutions are probably safer than anyone else because they’re private and have large endowments — that gives them a little bit of independence. With that said, everyone is susceptible to financial threats,” Lauren Lassabe Shepherd, a historian of American higher education at the University of New Orleans, told the News. “I’m sure trustees everywhere will be wary of the potential damage that upsetting Trump as president could bring to them.”

Yale’s endowment is used for a variety of functions across the University from teaching and research to student financial aid. In 2023, Yale used 18 percent of its endowment income for student aid and 25 percent for teaching and research purposes.

In his new presidential term, however, Trump has proposed taxing university endowments as a whole, calling to fine them “the entire amount of their endowment.”

The revenue generated by such taxes would go towards the American Academy, a strictly nonpolitical free online college that Trump has discussed in his Agenda 47 presidential plan. The tax is described in Agenda 47’s plan as “protecting students from the radical left and Marxist maniacs infecting educational institutions.”

The University spokesperson wrote to the News that Yale is “following a number of policies” pertaining to higher education while highlighting the importance of the endowment as a mode of financial accessibility for students.

“We will seek opportunities to reinforce the essential role that colleges and universities play in enhancing civic life, fostering economic opportunity, and building a strong economy,” the spokesperson wrote. “In addition, we will affirm the importance of all sources of funding that support accessibility and excellence in higher education, such as Pell Grants, the National Institutes of Health, and philanthropy, including endowments.”

Katharine Meyer, a fellow in the Governance Studies program for the Brown Center on Education Policy at Brookings, explained that while the amount of revenue generated depends on the proposed percentage, “any sort of endowment tax is just bringing in pennies to the department.”

“It’s not a serious or large potential revenue source, but purely to act as, whether you see that as a punishment or an incentive, to get universities to engage in certain practices,” Meyer said.

Meyer also said that any federal endowment tax would “open the door” for increased conversations on state endowment taxes. She explained that states that aim to run balanced budgets constantly seek new revenue sources and might also explore state endowment taxes. Depending on the percentage proposed, which is likely to be only a “small shock,” universities with larger endowments could absorb the shock.

Shepherd told the News that while she does not believe Trump will try to tax endowments, it would likely be a mechanism to “enforce universities to crack down on student dissidents, especially as it relates to Gaza.”

However, she also speculated that if he were to implement the tax, institutions with large endowments might cut back on student aid even if they “could be tuition-free and live off their endowments alone.”

Lewis told the News that the University and others in the American Association of Universities are communicating with Congress across party lines about the importance of research and teaching. He also shared he is “hopeful” that Trump’s endowment tax proposal will not expand.

McInnis said that Yale and peer institutions should work to communicate to the public the value that their institutions provide to the nation.

“Yale as a name brand obviously has a very important role to work on making sure that the public understands the really important things we do in service of this nation — the research that we generate that creates economic development, that leads to medical discoveries and treatments, that creates new technologies … the role we play in educating future leaders, the role we play in continually expanding access to a greater number of students from lower socioeconomic strata or who are first generation,” McInnis said.

As of June 30, 2024, Yale University’s endowment was valued at $41.4 billion.

Yolanda Wang contributed reporting.