Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Chainlink (LINK) is up 21% from its Sunday lows, gaining momentum in an otherwise uncertain macro and geopolitical environment. While global tensions continue to spark volatility across markets, Chainlink has stood out for its resilience, supported by a series of strong partnerships and growing on-chain fundamentals. The recent price action signals a potential shift in trend, but analysts warn that a confirmed breakout is still needed before bulls can fully take over.

Related Reading

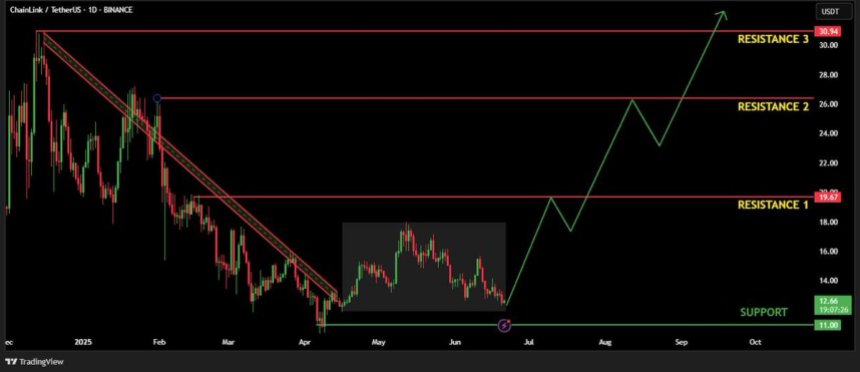

Top analyst Henry Lord of Alts highlighted that LINK has endured months of persistent downtrend and unusually quiet price behavior. However, recent moves suggest that something is changing beneath the surface. Volume is increasing, volatility is picking up, and LINK is forming a base structure that could mark the end of its accumulation phase.

Despite this strength, Chainlink remains technically locked within a consolidation range. A clean breakout above key resistance levels will be critical to trigger the next phase of upward momentum. Until then, traders are cautiously optimistic as LINK teases a larger move.

Chainlink Prepares For A Decisive Move

Chainlink is currently trading over 25% below its May high, reflecting the broader market impact of rising macroeconomic uncertainty and geopolitical tensions, especially the recent Middle East conflicts. Despite these pressures, LINK has managed to hold within a steady consolidation range, signaling resilience as the crypto market awaits its next decisive move.

Maintaining prices above current levels is crucial. A breakdown here could open the door for deeper corrections. However, analyst Henry believes the tides may be turning. According to Henry, Chainlink has endured months of downtrend and silence, but a structural shift is now underway. His analysis highlights that the long-standing downtrend has been broken, and LINK has entered a clear accumulation and consolidation phase.

“These zones often come before the loudest moves,” Henry notes. Historically, such phases have preceded explosive rallies, and this time may be no different. If momentum picks up, a breakout toward the $25–$30 range wouldn’t be surprising.

Henry also points out that periods of inactivity often mask the actions of smart money—buying quietly before the broader market catches on. While it’s easy to overlook assets during calm phases, that’s often when the groundwork for major moves is laid. For now, Chainlink remains on watch.

Related Reading

LINK Price Analysis: Signs of Reversal Emerge

Chainlink is showing early signs of a trend reversal after months of consistent decline. As seen in the 12-hour chart, LINK recently rebounded from the $11.50 level and is now trading above $13.20. This recovery follows a steep drop that marked a new local low, but the bounce has pushed the price above the 50-day simple moving average (SMA), now acting as short-term support at $13.50.

Importantly, LINK is now testing the 100-day SMA (around $14.65), which previously served as resistance in late May and early June. If bulls manage to break and consolidate above this level, the next target lies near the 200-day SMA at $14.16—a confluence zone that may act as a critical decision point for trend continuation or rejection.

Related Reading

While the macro structure remains bearish, this short-term accumulation range suggests growing demand, especially as the price begins to form higher lows. A clear break above $14.65 with volume could confirm the breakout and signal the start of a larger move toward the $17–$18 range.

Featured image from Dall-E, chart from TradingView