A year ago, I set out to break into Quant Finance. I had several years of experience in the financial services industry, working across roles in major banks, hedge funds, and alternative asset consulting firms. Much of my experience was in tech, development, and operations, as I detailed in this post on transitioning from DevOps to Quant Finance.

Since that post, I’ve landed a role as a Macro Strategy Engineer at a major hedge fund, collaborating with quant researchers and strategists to maintain stable trading operations across macro asset classes like FX, bonds, and credit derivatives. My responsibilities include supporting accurate pricing and reporting, utilizing Python and C# for model validation, and managing trading infrastructure for scalability and resilience.

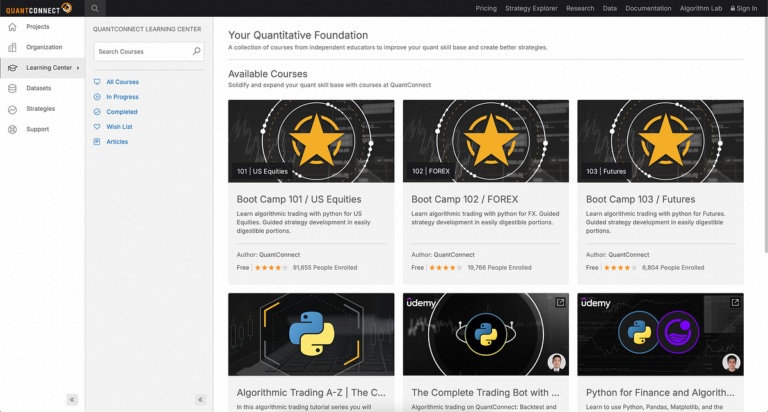

Along the way, I utilized a variety of resources to deepen my knowledge of financial instruments, quantitative development, software engineering best practices, C++ programming, and Python-based algorithmic trading. I also worked extensively on back testing frameworks, Monte Carlo simulations, data visualization, and asset-pricing models.

Here are some of the key resources that helped me build the skills necessary to break into quant finance: